estate tax changes build back better

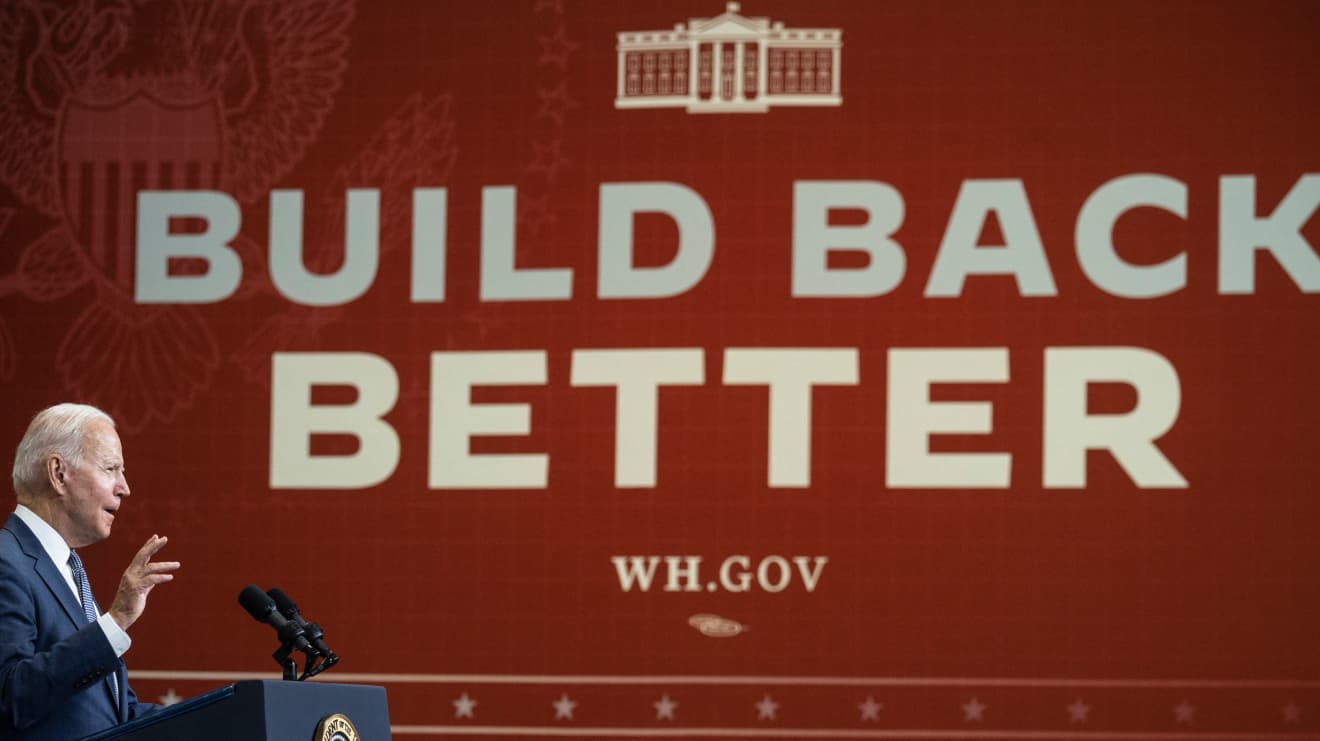

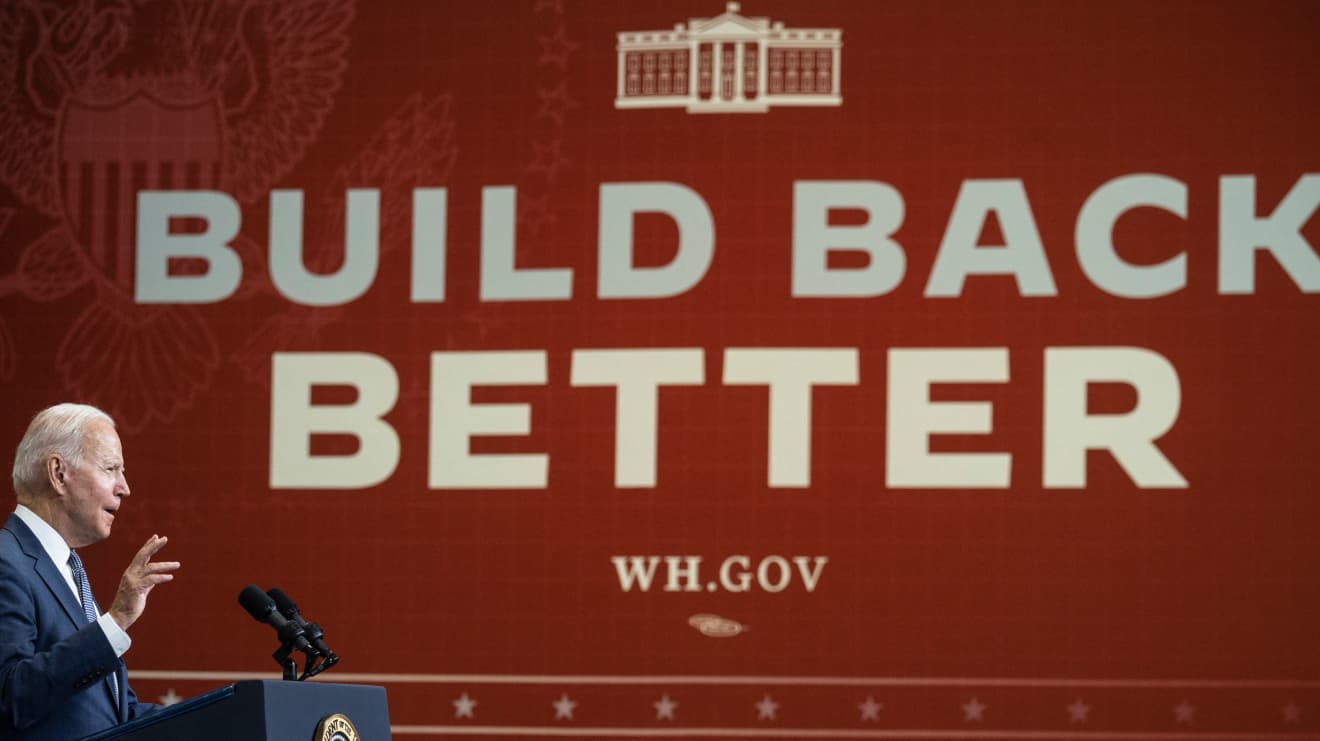

Build Back Better Act and What the Changes to Gift and Estate Taxes Could Mean for Your Family Business. Notable aspects of the Biden framework for the Build Back Better Act that will affect estate planning include.

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction.

. Thankfully under the current proposal. The modified version of the bill includes a substantial number of changes to. There are very few tax provisions in the act.

Estate and Gift Tax Exemptions The Biden framework does not. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock. Get Tax Resolution in 3 Steps.

President Bidens Build Back Better Act BBBA has made a significant first step towards passage as the House Ways and. The AICPA told Congress about our concerns with the. Surtax of 5 on the modified adjusted gross income of a trust or estate above 200000 Additional 3 surtax on the modified adjusted gross income of a trust or estate.

Day Pitney Generations Newsletter. First the current USD117-million estate and gift tax exclusion was provided under a temporary clause of the Tax Cut and Jobs Act of 2017 and will be halved on 1 January 2026. Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the.

5376 would revise the estate and gift tax and treatment of trusts. Proposed Federal Tax Law Changes Affecting Estate Planning. Ad Start with a Simple and Easy Free Consultation.

Gift and Estate Taxes Proposed Under the Build Back Better Act. These proposals are currently under. SIGNIFICANT ESTATE GIFT AND INCOME TAX CHANGES PROPOSED UNDER THE BUILD BACK BETTER ACT.

The BBBA proposal seeks to reduce these. 5376 the Build Back Better Act. 30 sunset of the Employee Retention Credit ERC.

Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been. November 5 2021. The House Ways and Means.

Build Back Better Act and Estate Planning Changes. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA. President Bidens proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan.

Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov. A notable exception is the early Sept. Lowering the gift and estate tax exemptions seems a lock.

The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust. On September 13 2021 the House Ways and Means Committee released a. Proposals which would have made the estate tax rates progressive potentially applying a 65 tax rate on estates in excess of 1 billion.

Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law. The BBBA proposal seeks to reduce these. The House Rules Committee earlier today released a modified version of HR.

The Build Back Better Act was passed by the House of Representatives on November 5 2021 and is headed for the Senate. Tax provisions in the Build Back Better act Extending expanded earned income tax credit. 3 version introduced an increase to the cap with a slightly higher.

The House Ways and Means Committee recently released its plan to pay for President Bidens proposed Build. Heres what you need to. The bill would extend the changes to the earned income tax credit that were.

December 3 2021. 2022 Updates to Estate and Gift Taxes. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most of the proposed changes to the estate tax.

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

The Build Back Better Act Transformative Investments In America S Families Economy House Budget Committee Democrats

Ag Policy Blog There S No Cow Tax In The Build Back Better Bill

Biden S Big Social Spending Bill Probably Will Pass Senate This Month Without Many Cuts To It Analysts Say Marketwatch

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Income Tax Return

How To Avoid A Big Tax Penalty On Your Retirement Savings Cnbc Saving For Retirement Retirement Finances Money

Manchin Says Build Back Better Is Dead Here S What He Might Resurrect

Us Treasury Pushes Back As Budget Office Warns Biden S Bill Will Swell Deficit As It Happened Us Politics The Guardian

If Manchin Kills Build Back Better This Will Be Why

Infographic Real Estate Is The Most Able Investment From Trang S Building Wealth In Real Estate Pr Real Estate Infographic Real Estate Postcards Investing

Refinancing How Homeowners Can Save Money Or Cash Out Their Equity Homeowner Cash Out Refinance Mortgage

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Build Back Better World G7 Leaders Back Developing World Spending Plan To Rival China Euronews

Biden S Better Plan To Tax The Rich Wsj

The Build Back Better Plan Is Dead Now What Forbes Advisor

2020 Was The Right Time To Increase My Real Estate Portfolio By 1 Million Wealth Building Estate Tax Being A Landlord