10200 unemployment tax break refund update

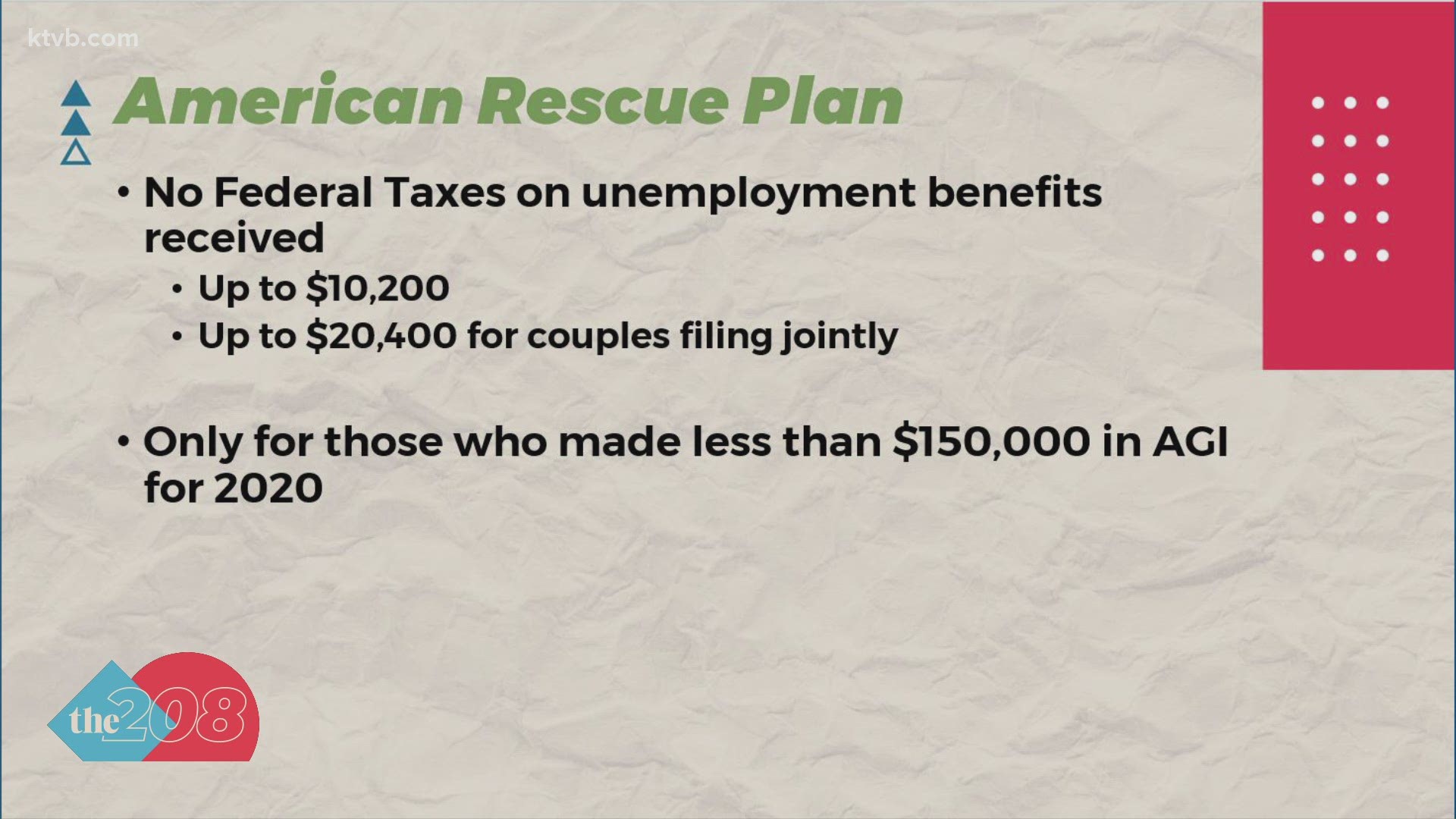

At this stage unemployment. The 19 trillion Covid relief bill gives a federal tax break on up to 10200 of unemployment benefits.

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Those amending their income to remove unemployment.

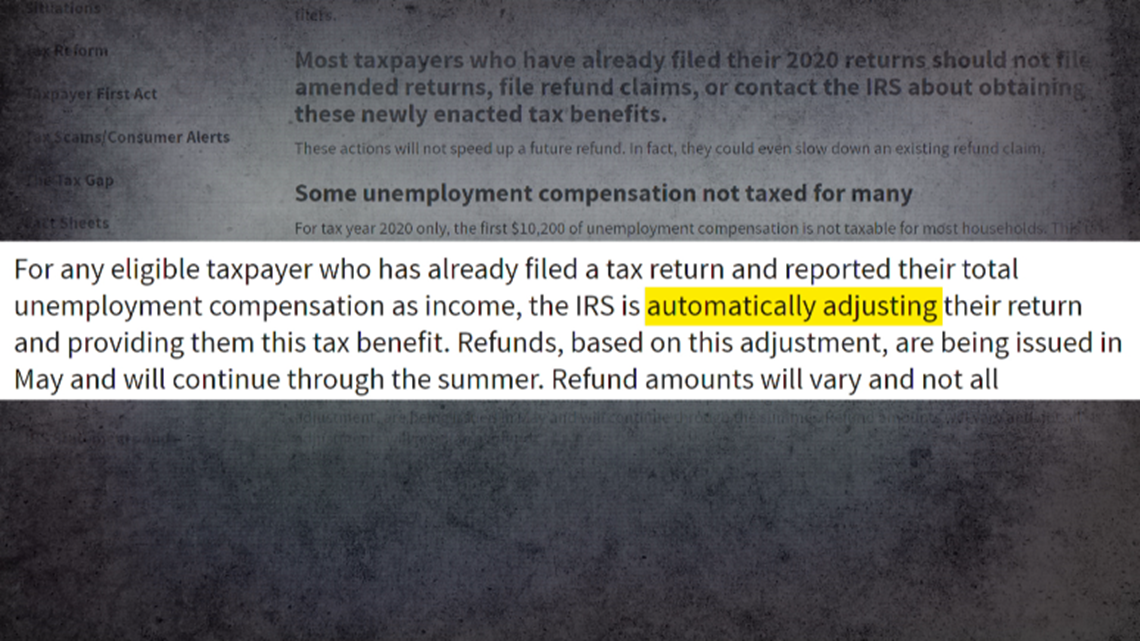

. Enter the original amount you reported in column A the change in column B and the corrected amount in column C. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. There have been unconfirmed reports of people.

Unemployment Tax Refund Update 10 Things You Need To Know. UNEMPLOYMENT 10200 TAX BREAK. TurboTax and HR Block updated their online software to account for a new tax break on unemployment benefits received in 2020.

With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption If you received. ONLY THOSE WHO ARE AWAITING A SECONDARY REFUND DUE TO THE 10200 UNEMPLOYMENT TAX BREAK. A last minute addition to the 19 trillion stimulus package exempted the first 10200 of 2020 unemployment compensation from federal income tax for households.

If your modified adjusted gross income AGI is less than 150000 then you can exclude up to 10200 of unemployment compensation paid in 2020 from your taxable income. For anyone expecting an extra refund you can now go on the IRS. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

15 million more refunds from the IRS are coming with the latest batch of payments. Generally unemployment compensation received under the unemployment compensation laws of the. The American Rescue Plan a 19 trillion.

The amount of the refund will vary per person depending on overall. A quick update on IRS unemployment tax refunds today. For tax year 2020 the first 10200 of unemployment compensation received by a taxpayer was excludable from income ie not taxable This tax.

The exact refund amount will depend on the persons overall income jobless benefit income and tax. The 10200 Unemployment Tax Break. That law waived taxes on up to 10200 in.

The latest pandemic relief legislation signed into law on March 11 in the thick of tax season made the first 10200 of unemployment benefits tax-free in 2020 for people with. Q A. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020.

Unemployment Tax Refund Advice Needed R Irs

Unemployment Update Confirmed Automatic 10 200 Unemployment Tax Free Refund Check Youtube

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

Unemployment Benefits In Ohio How To Get The Tax Break

Kare 11 Investigates Irs Facing Worst Tax Return Backlog In History Kare11 Com

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Q A The 10 200 Unemployment Tax Break Williams Cpa Associates

Unemployment Refund Where S My Refund

Unemployment Benefits Will Be Taxed In Idaho Despite Provision In Biden S Relief Bill Ktvb Com

Unemployment Refund Where S My Refund

Unemployment Tax Break Hoh 3 Dependents Taxes Were Not Withheld During Unemployment Had This Date Of June 14th Pop Up On May 28th Then It Disappeared And Went Back To As Of

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

When To Expect Your Unemployment Tax Break Refund

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

Millions Might Get A Refund With The 10 200 Unemployment Tax Break But Filing An Amended Return Could Unlock Even More Money Marketwatch